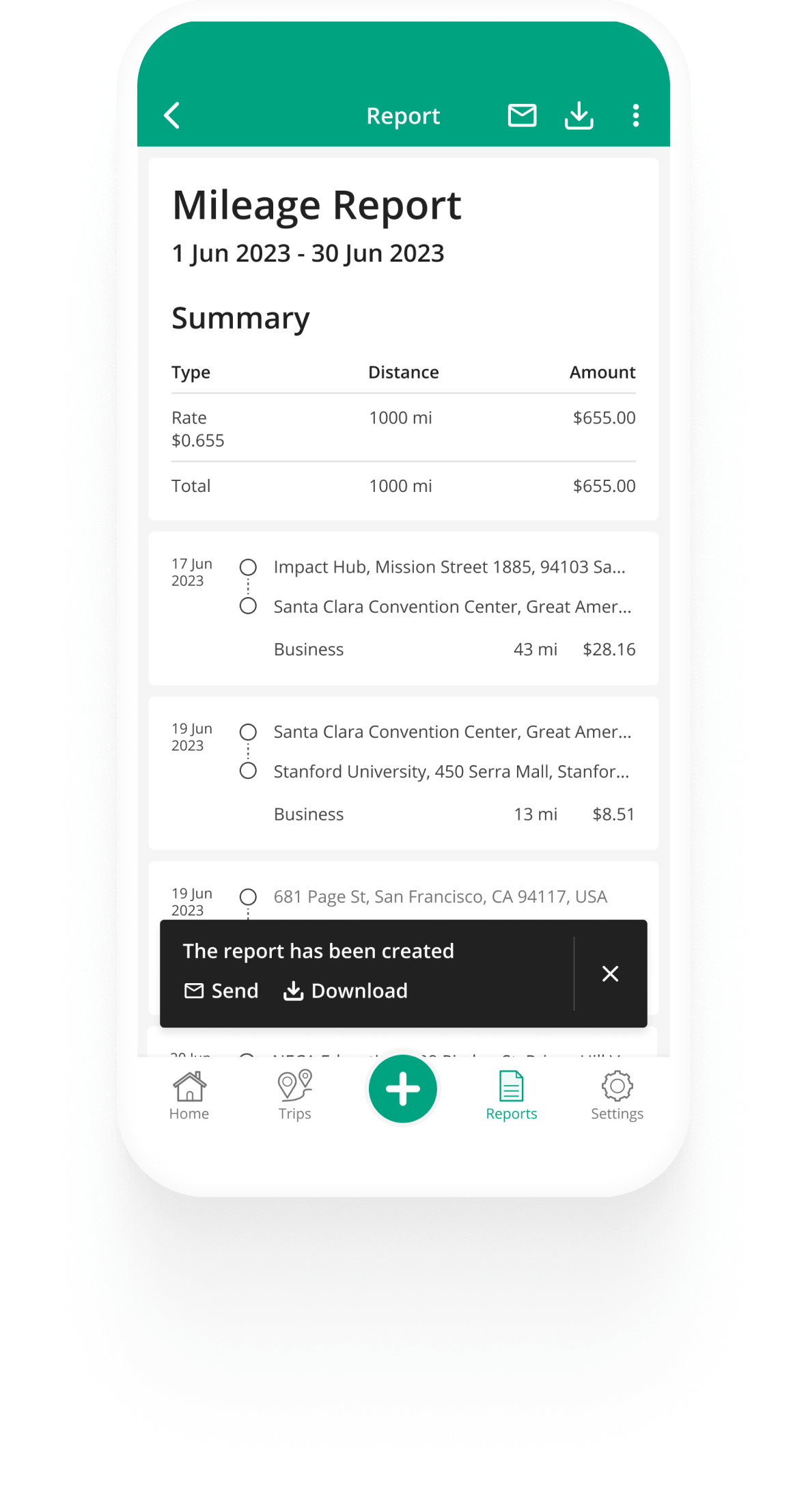

Your report is ready when needed

Your mileage documentation is ready when you are. You’re only one click away from detailed reports available on mobile and desktop.

Your mileage documentation is ready when you are. You’re only one click away from detailed reports available on mobile and desktop.

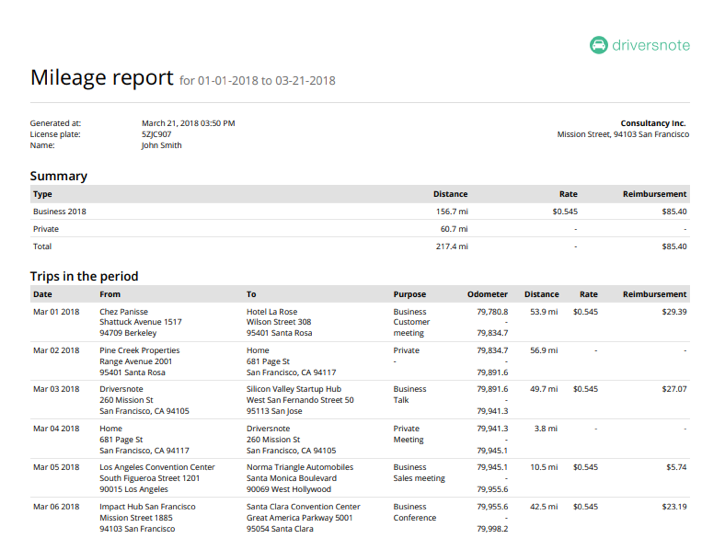

Get a customizable report of all of your trips, downloadable as a PDF or Excel file, ready to hand over to your employer or accountant.

The report contains the details required by IRS, ready to be used as documentation for reimbursement claims or tax deductions.

From the get-go, your reimbursements will be calculated automatically based on the current standard rates from IRS. If you’d like, you can instead set custom rates or choose not to calculate reimbursements at all.

If you need to regularly document the status of your car’s odometer, we’ve got you covered. We make it easy to log and can even send you reminders. You choose how often to log the odometer, and we do all the math for you and include it in your report.

Do you need to keep a mileage log for multiple vehicles or report mileage to more than one employer? No problem. You can easily segment your trips and reporting for different vehicles and workplaces.

Yes, you can share your mileage logs through Driversnote; just tap Send and enter the recipient's email.

You can set a custom reporting period, which makes it easier to regularly create reports with a standard time frame - weekly, fortnightly, monthly, and so on. You can choose to be notified via email when you need to create a report.

The Driversnote mileage tracking app allows you to keep mileage logs for separate workplaces. When creating a mileage report, simply select the Workplace you want to report your mileage for and the log will only contain mileage for that specific workplace.