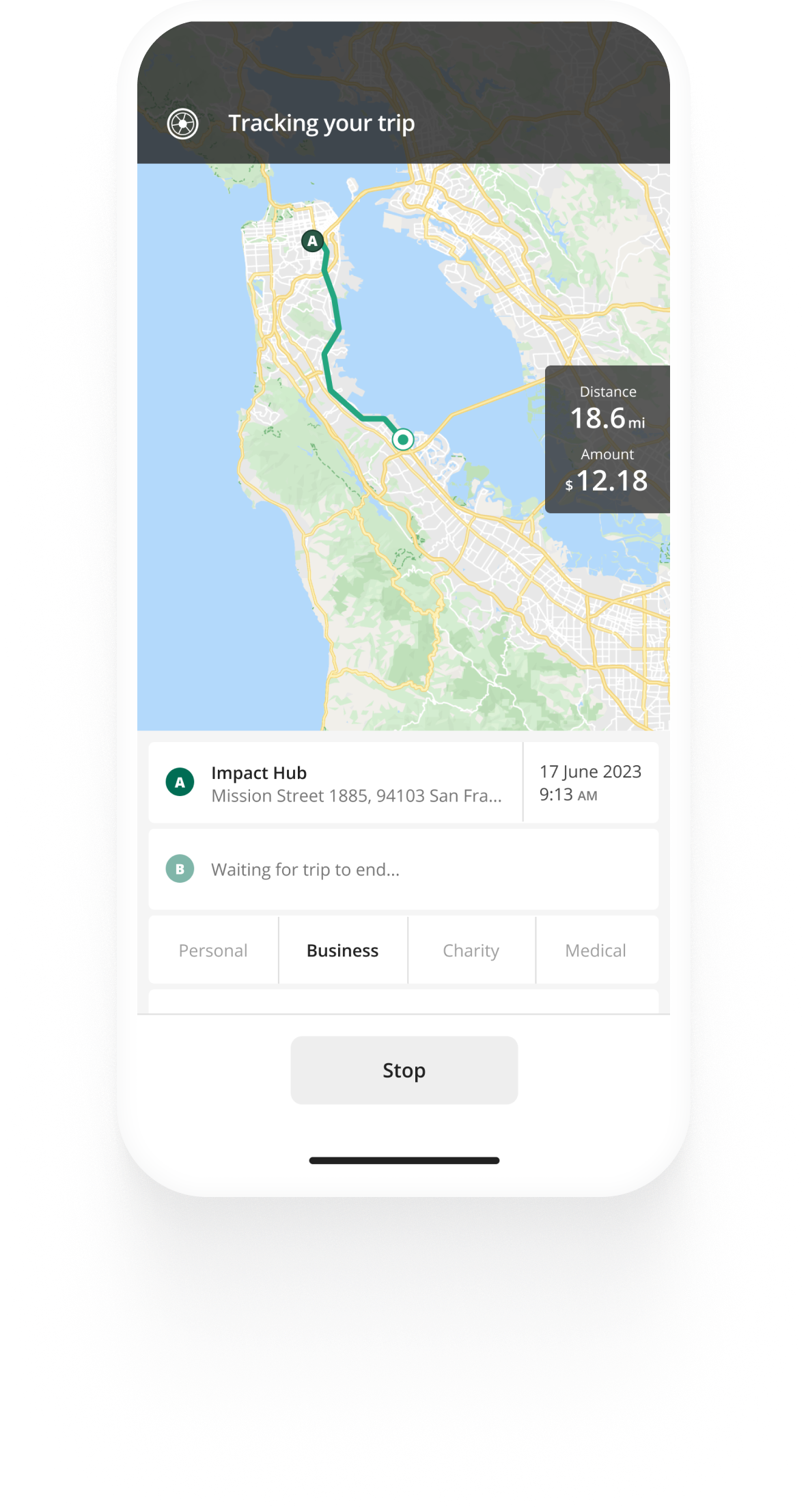

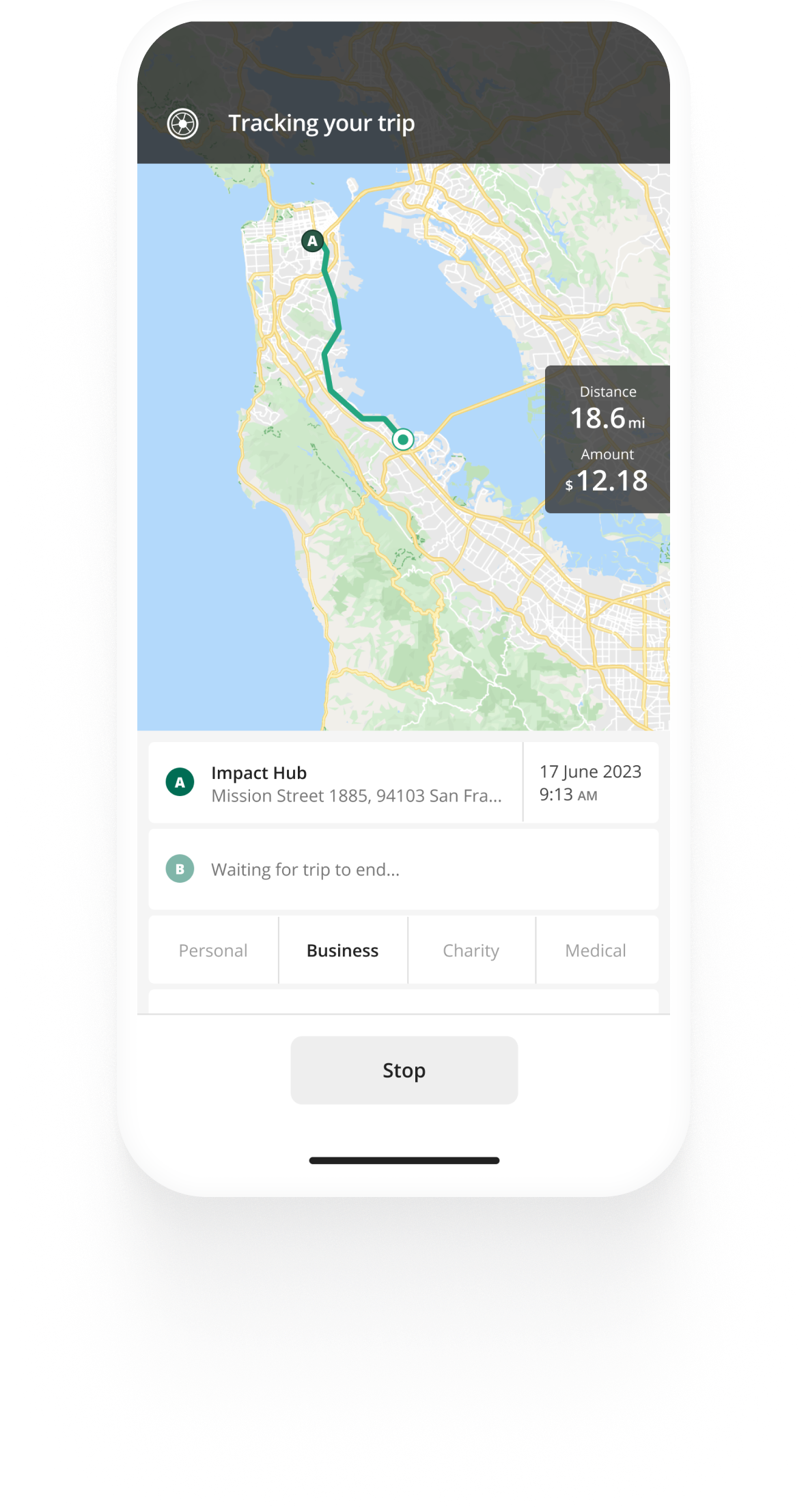

Track mileage automatically

Get startedIs Mileage Reimbursement Taxable Income?

Mileage reimbursement is not considered taxable income, as long as you do it right.

In this short article you will learn how to avoid pitfalls and get your reimbursement tax free.

An inevitable step is to keep a detailed mileage logbook. With Driversnote as your mileage tracker, your trips are automatically logged just the way the IRS likes it.

When is mileage reimbursement not taxed as income?

If the following requirements are met, mileage reimbursement is not taxable:

- Your employer uses the IRS standard mileage rate to reimburse your business-related driving

- The reimbursement happens under an Accountable Plan.

In short, to be considered accountable, the reimbursement must be based on services done for an employer (i.e. for business), be adequately accounted for and any mileage allowance excess is returned within a reasonable period of time.

The IRS lists the details of Accountable Plans online. We recommend you read through our appropriate guide for employees, employers or self-employed as well as the requirements for mileage records to make sure your reimbursement will not be taxed.

Mileage tracking made easy

Trusted by millions of drivers

Automate your logbook Automate your logbook

When is mileage taxable?

Any reimbursement that is considered "nonaccountable", e.g. does not meet the requirements for an Accountable Plan, is taxable as income. This includes:

- Any excess reimbursement, compared to the IRS' standard mileage rate.

- Any excess reimbursement that was paid out but not returned in a reasonable time.

- Any reimbursement that is not based on adequate records.

It does not matter how exactly you are reimbursed as an employee — mileage allowance and reimbursements are both compared to the IRS mileage rate. As long as they are less than or equal to the rate and accountable, the reimbursement will not be taxed.

FAQ

How to automate your mileage logbook

IRS Mileage Guide

- For Self-Employed

- For Employees

- For Employers

- Mileage Log Requirements

- How To Claim Your Mileage On Taxes In 5 steps

- Calculate Your Reimbursement

- Is Reimbursement Taxed?

- Current Mileage Rates

- IRS Mileage Rates 2022

- IRS Mileage Rates 2021

- IRS Mileage Rates 2020

- IRS Medical And Charitable Mileage

- California Mileage Reimbursement

- How The IRS Mileage Rate Is Set