Track mileage automatically

Get started2020 Mileage Rate

The 2020 mileage rate was announced by the IRS on Dec 31st, 2019. The rate for business is 57.5 cents per mile, down half a cent from 2019.

The rates for medical and moving dropped to 17 cents per mile for 2020, while the rate for miles driven in service of charitable organizations remains the same at 14 cents per mile. Scroll further down to see all current and previous mileage rates.

The rates cover the cost of using your personal vehicle for certain things, most commonly for business, but also if you drive for medical, moving, or charitable purposes. Each of these has a different rate and rules.

Be aware that the standard mileage rate is optional — both your state and employer may use different rates.

If you want to know more, we have written a quick guide for employees on mileage reimbursement, as well as mileage tax deductions for self-employed.

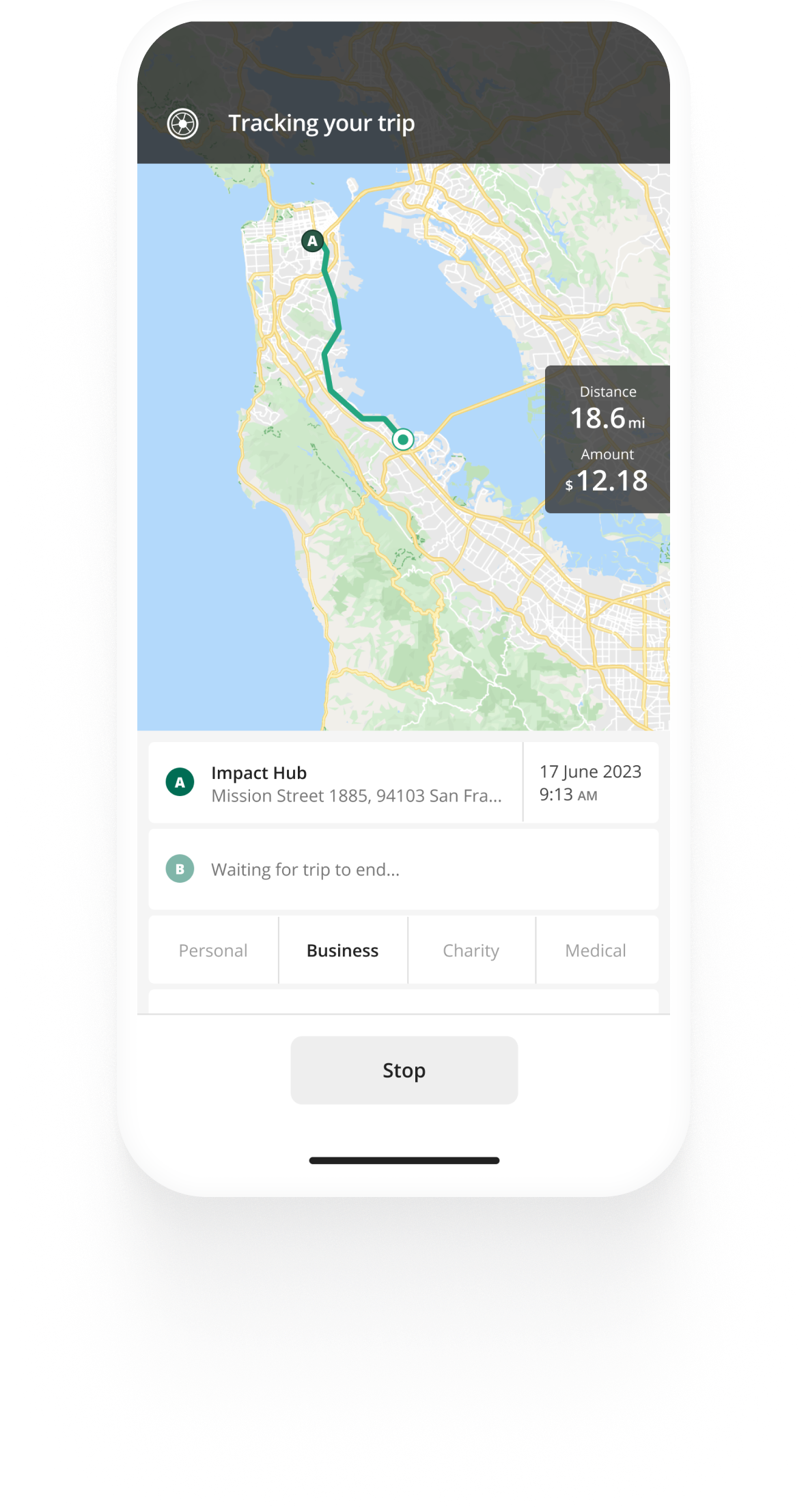

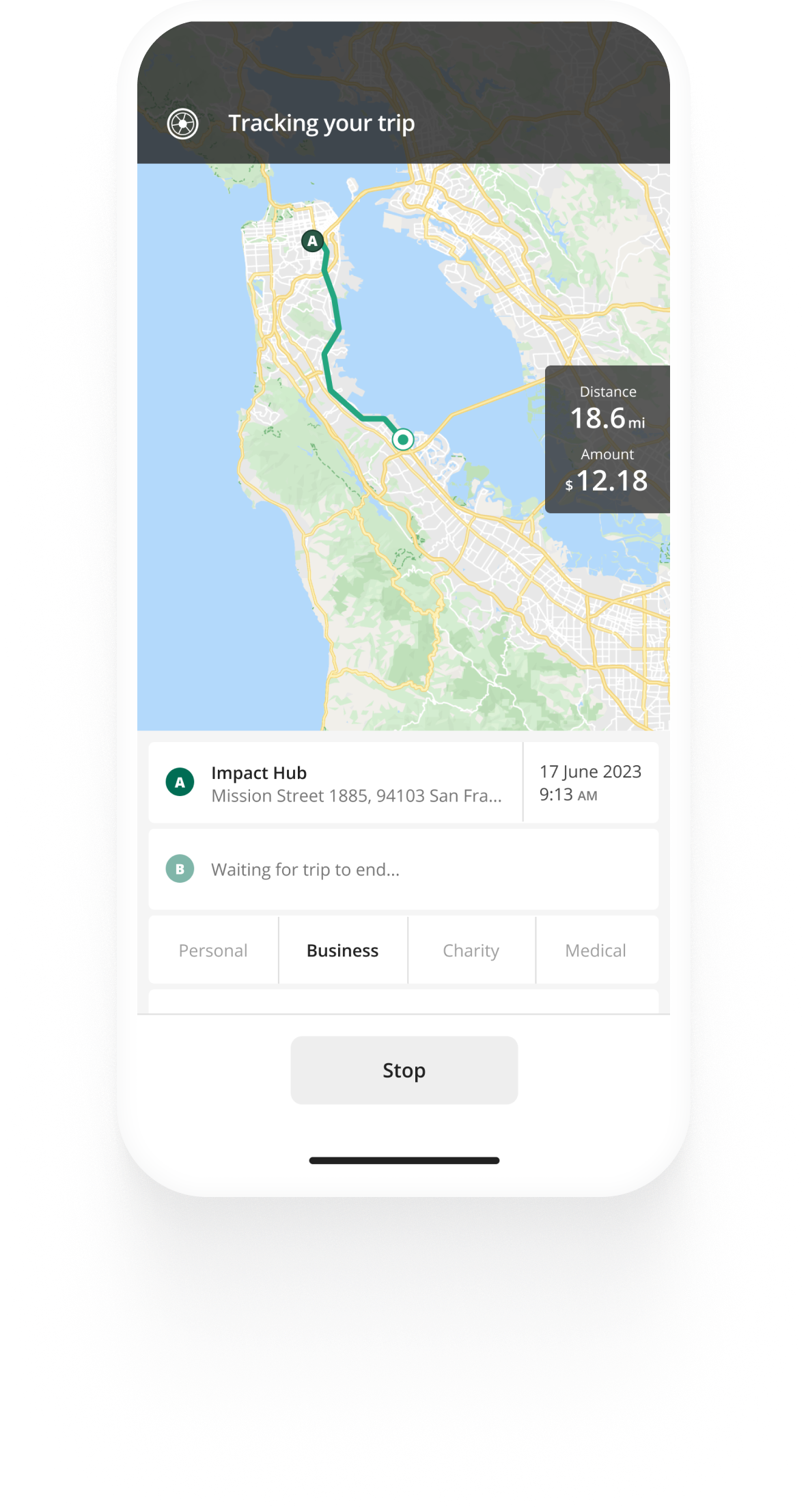

Log your business travel and calculate your reimbursements automatically. The Driversnote mileage tracking app is always up to date on laws and the IRS mileage rates.

IRS mileage rate 2020

The IRS mileage rates for 2020 for cars (including vans, pickups, and panel trucks) are:

- $0.575 per mile driven for business

- $0.17 per mile for trips taken on for medical purposes

- $0.17 per mile for moving (only Armed Forces on active duty)

- $0.14 per mile driven in the service of charitable organizations

The IRS announcement came on Dec 31st, 2019 and has additional information about rates and how they apply.

Mileage tracking made easy

Trusted by millions of drivers

Automate your logbook Automate your logbook

The IRS standard mileage rates for 2019

As of January 1st, 2019, the mileage rates were:

- $0.58 per mile driven for business

- $0.20 per mile for trips taken on for medical purposes

- $0.20 per mile for moving (only Armed Forces on active duty)

- $0.14 per mile driven in the service of charitable organizations

Here is the IRS announcement of the 2019 mileage rates.

Who decides the rate, and how?

To determine next year's rate, The IRS looks at the average costs of owning (fixed costs) and operating (variable costs) a vehicle this year.

In short, the rate for business use is based on the average cost of ownership plus the average operating costs of a car, while the rates for moving and medical are based only on the operating costs. The mileage rate for charity set by statute has remained unchanged since 1998.

FAQ

How to automate your mileage logbook

IRS Mileage Guide

- For Self-Employed

- For Employees

- For Employers

- Mileage Log Requirements

- How To Claim Your Mileage On Taxes In 5 steps

- Calculate Your Reimbursement

- Is Reimbursement Taxed?

- Current Mileage Rates

- IRS Mileage Rates 2022

- IRS Mileage Rates 2021

- IRS Mileage Rates 2020

- IRS Medical And Charitable Mileage

- California Mileage Reimbursement

- How The IRS Mileage Rate Is Set