Track mileage automatically

Get startedHow To Calculate Your Mileage Reimbursement

Calculating mileage reimbursements is a rather straightforward process - the IRS provides an official mileage rate each year which you can use to work out your mileage reimbursement for business-related driving.

IRS rate for calculating mileage reimbursements

The 2024 IRS rate for calculating mileage reimbursement is 67 cents per mile. Last year's rate was 65.5 cents per mile.

Mileage tracking made easy

Trusted by millions of drivers

Automate your logbook Automate your logbook

Calculate mileage reimbursement for work

As an employee, if you drive your personal vehicle for business-related purposes, and your company uses the IRS standard mileage rate to reimburse you, follow the example below.

You have kept mileage records throughout January 2024, and they show that you've driven 180 miles for business. The 2024 standard mileage rate is 67 cents per mile. To find your reimbursement, you multiply the number of miles by the rate:

[miles] * [rate], or 180 miles * $0.67 = $120.60

Keep in mind that your employer is not obligated to use the IRS rate for mileage reimbursement, they can choose to reimburse you at another rate per mile, or by another reimbursement scheme such as lump sum allowances or FAVR (fixed and variable reimbursement).

You can also use the calculator below to calculate your mileage for 2024.

Calculate mileage for taxes

As self-employed, you can calculate and claim a mileage deduction on your annual tax return. The simplest method for calculating your mileage is the standard mileage rate method. You should use the corresponding year’s mileage rate set by the IRS - e.g. if you are claiming business mileage you’ve driven in 2023, you should be using the standard mileage rate for 2023.

For example, if you drove 1200 business miles in 2023 with your personal vehicle, and the IRS mileage rate for the same year is 65.5 cents per mile, your calculation will look as follows:

[miles] * [rate], or 1200 miles * $0.655 = $786 you can claim as a deduction on your tax return.

If you decide to calculate mileage for taxes by the actual expenses method, you will need to keep all receipts of your car expenses. Learn more about calculating mileage by the actual expenses method.

More information on tracking mileage and record keeping for your situation

For more information on calculating mileage for taxes or reimbursement, we suggest you continue reading our dedicated mileage reimbursement for employees and mileage deductions for self-employed guides. See the mileage log requirements you should adhere to in order to get your mileage reimbursed or deduct it from your taxes.

FAQ

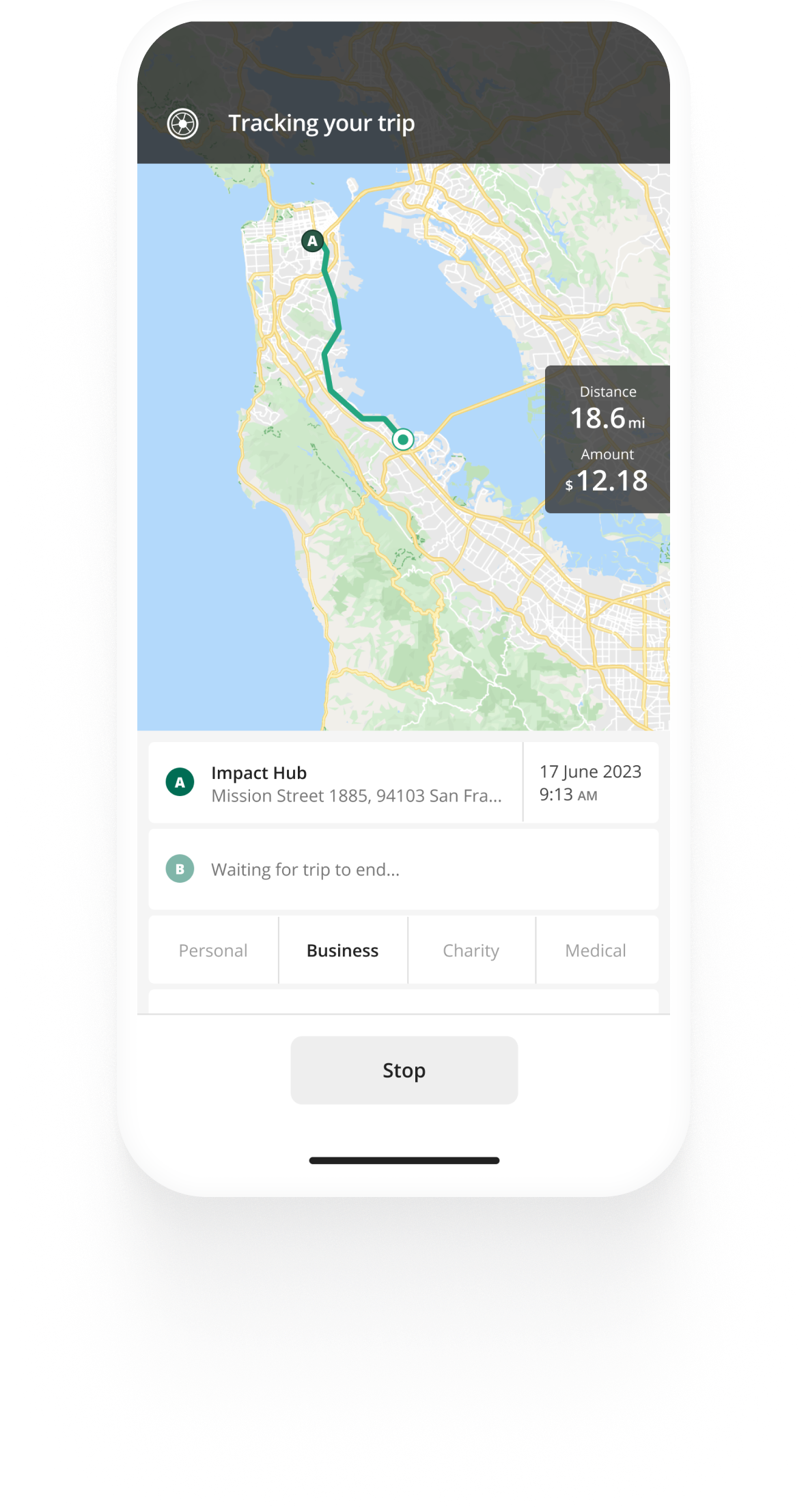

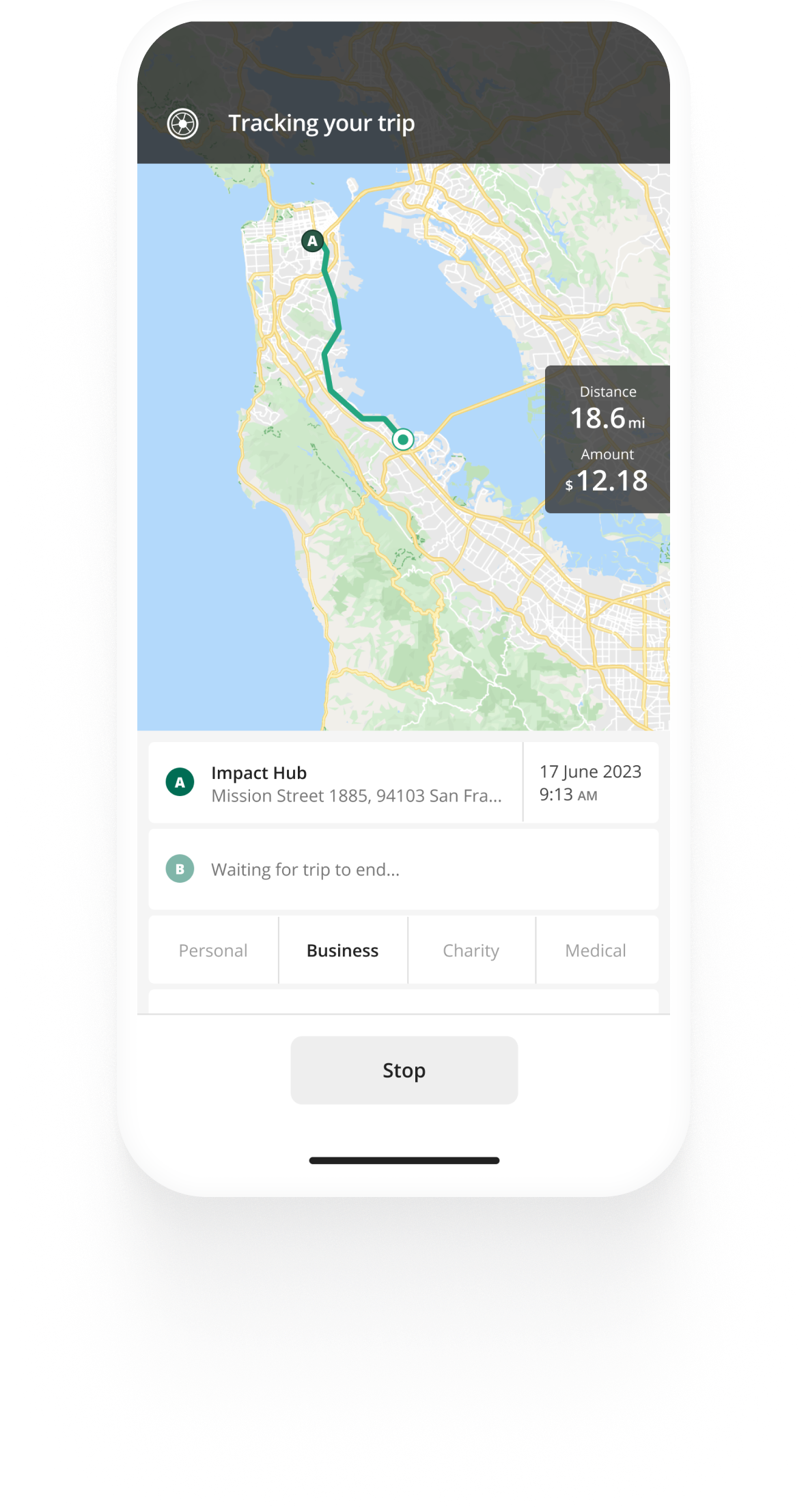

How to automate your mileage logbook

IRS Mileage Guide

- For Self-Employed

- For Employees

- For Employers

- Mileage Log Requirements

- How To Claim Your Mileage On Taxes In 5 steps

- Calculate Your Reimbursement

- Is Reimbursement Taxed?

- Current Mileage Rates

- IRS Mileage Rates 2022

- IRS Mileage Rates 2021

- IRS Mileage Rates 2020

- IRS Medical And Charitable Mileage

- California Mileage Reimbursement

- How The IRS Mileage Rate Is Set